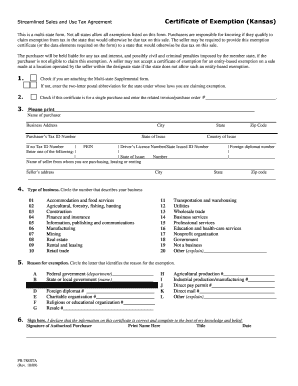

KS DoR PR-78SSTA 2022-2025 free printable template

Show details

See instructions on back page 2 ID number AR GA IA IN KS KY MI MN NC ND NE NJ State/Country Reason NV OH OK RI SD TN UT VT WA WI WV WY I declare that the information on this certificate is correct and complete to the best of my knowledge and belief. Signature of Authorized Purchaser SSTGB Form F0003 PR-78SSTA Rev. 3-22 Print Name Here Exemption Certificate Title Date Sections 1 6 are required information. A signature is not required if in electronic form. Section 1 Check the box for a single...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign form pr 78ssta

Edit your pr 78ssta form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your pr 78 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing kansas tax exempt form online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit kansas tax exemption certificate form. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

KS DoR PR-78SSTA Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out kansas exemption certificate form

How to fill out KS DoR PR-78SSTA

01

Gather all necessary documents and information required to complete the form.

02

Begin by filling out the personal identification section, including your name, address, and contact information.

03

Proceed to the section that requires specific details about the transaction or request for which the form is being submitted.

04

Carefully read and fill out any required declarations or statements as specified in the form.

05

Review the completed form for accuracy and ensure that all sections are filled in completely.

06

Sign and date the form where required.

07

Submit the form through the specified method, whether by mail, in-person, or online.

Who needs KS DoR PR-78SSTA?

01

Individuals or businesses that are involved in transactions requiring official record-keeping or regulatory compliance.

02

Those who need to report a specific event or activity that is mandated by the Kansas Department of Revenue.

Fill

kansas sales tax exemption certificate

: Try Risk Free

People Also Ask about kansas tax exempt certificate

What is a Texas sales and use tax exemption?

Leased or purchased machinery, equipment, replacement parts, and accessories that have a useful life of more than six months, and that are used or consumed in the manufacturing, processing, fabricating, or repairing of tangible personal property for ultimate sale, are exempt from state and local sales and use tax.

How do I become sales tax exempt in Texas?

To apply for exemption, complete AP-204. Include any additional documentation to show the corporation meets the requirements. Non-Texas corporations must also include a copy of the corporation's formation documents and a current Certificate of Existence issued by their state of incorporation.

How to get a sales tax exemption certificate in North Carolina?

North Carolina does not require registration with the state for a resale certificate. How can you get a resale certificate in North Carolina? To get a resale certificate in North Carolina, you may fill out the Streamlined Sales and Use Tax Agreement Certificate of Exemption Form (Form E-595E).

How long are NY tax exempt certificates valid?

You must keep the exemption certificate for at least three years from the due date of the sales tax return on which the last sale using the exemption certificate was reported. For more information, see Tax Bulletin Record-keeping Requirements for Sales Tax Vendors (TB ST-770).

Is Puerto Rico sales tax exempt?

Sales and use tax: 11.5 percent on most goods and services. 10.5 percent on goods and services not subject to municipal SUT. 4 percent on designated professional services and services rendered to other merchants (Special SUT).

How do I become farm tax exempt in Kansas?

Two conditions must be met to claim this exemption. The buyer must be engaged in farming or ranching as defined on this page, and the property purchased, repaired or serviced must be used only in farming and ranching.

What is the tax exempt form for NYS?

If you have a valid Certificate of Authority, you may use Form ST-121 to purchase, rent, or lease tangible personal property or services exempt from tax to the extent indicated in these instructions. Complete all required entries on the form and give it to the seller.

What is the number for NYS sales tax certificate of authority?

Duplicate Certificate of Authority If you are already registered for sales tax with the Tax Department but need a duplicate copy of your Certificate of Authority because the original was misplaced or destroyed, you can call us at (518) 485-2889.

What is the difference between an exemption certificate and a resale certificate in Texas?

Exempt certificates and resale certificates are very similar documents with the major difference being that an exemption certificate does not require a taxpayer ID number to be legally valid.

How do I claim exemption on my tax form?

To be exempt from withholding, both of the following must be true: You owed no federal income tax in the prior tax year, and. You expect to owe no federal income tax in the current tax year.

How do you qualify for tax exemption in Texas?

To qualify for the general residence homestead exemption an individual must have an ownership interest in the property and use the property as the individual's principal residence. An applicant is required to state that he or she does not claim an exemption on another residence homestead in or outside of Texas.

How to fill out a Texas sales and use tax exemption certification?

An exemption certificate must show: (1) the name and address of the purchaser; (2) a description of the item to be purchased; (3) the reason the purchase is exempt from tax; (4) the signature of the purchaser and the date; and. (5) the name and address of the seller.

How do I file for tax exemption in Texas?

How do we apply for an exemption? To apply for franchise and sales tax exemptions, complete and submit Form AP-204, Texas Application for Exemption – Federal and All Others (PDF) to the Comptroller's office. Include a copy of the IRS-issued exemption determination letter with any addenda.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ks sales tax exemption certificate for eSignature?

When you're ready to share your sales tax exemption certificate kansas, you can swiftly email it to others and receive the eSigned document back. You may send your PDF through email, fax, text message, or USPS mail, or you can notarize it online. All of this may be done without ever leaving your account.

Where do I find kansas resale exemption certificate?

The premium subscription for pdfFiller provides you with access to an extensive library of fillable forms (over 25M fillable templates) that you can download, fill out, print, and sign. You won’t have any trouble finding state-specific kansas sales tax exemption form and other forms in the library. Find the template you need and customize it using advanced editing functionalities.

How do I execute tax exempt form kansas online?

pdfFiller has made it easy to fill out and sign kansas agriculture tax exempt form. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

What is KS DoR PR-78SSTA?

KS DoR PR-78SSTA is a form used by individuals and businesses in Kansas to report specific tax-related information to the Kansas Department of Revenue.

Who is required to file KS DoR PR-78SSTA?

Taxpayers who have certain tax obligations in Kansas, including businesses and individuals with income subject to specific regulations, are required to file KS DoR PR-78SSTA.

How to fill out KS DoR PR-78SSTA?

To fill out KS DoR PR-78SSTA, taxpayers should gather necessary financial information, follow the instructions provided with the form, and ensure all required fields are accurately completed before submission.

What is the purpose of KS DoR PR-78SSTA?

The purpose of KS DoR PR-78SSTA is to collect relevant tax information from taxpayers to ensure compliance with state tax laws and regulations.

What information must be reported on KS DoR PR-78SSTA?

Taxpayers must report their income, deductions, and other relevant financial data as specified in the form's instructions and guidelines.

Fill out your KS DoR PR-78SSTA online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Kansas Resale Certificate is not the form you're looking for?Search for another form here.

Keywords relevant to kansas tax exempt form pdf

Related to kansas project exemption certificate

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.